The longest bear market since 1948 has officially ended, and a new bull market in stocks has begun.

The official start to the bull market happened after the S&P 500 closed above 4,292 on Thursday, up 20% from its bear market closing low of 3,577 on October 12.

Beyond that, there's not much else to say.

Nothing special happens when the market crosses that 20% threshold, and there's nothing stopping stock prices from falling again. Labeling the recent rally in stocks as a new bull market is simply semantics, with a dash of investor psychology mixed in.

And the S&P 500 still has a long way to go before it passes its record closing high of 4,796, reached in the first week of January 2022. A surge to that level would require a 12% rally from current levels.

But there is some good news based on historical market data, and that is that it's extremely unusual for the stock market to quickly fall apart once the 20% bull market threshold is confirmed.

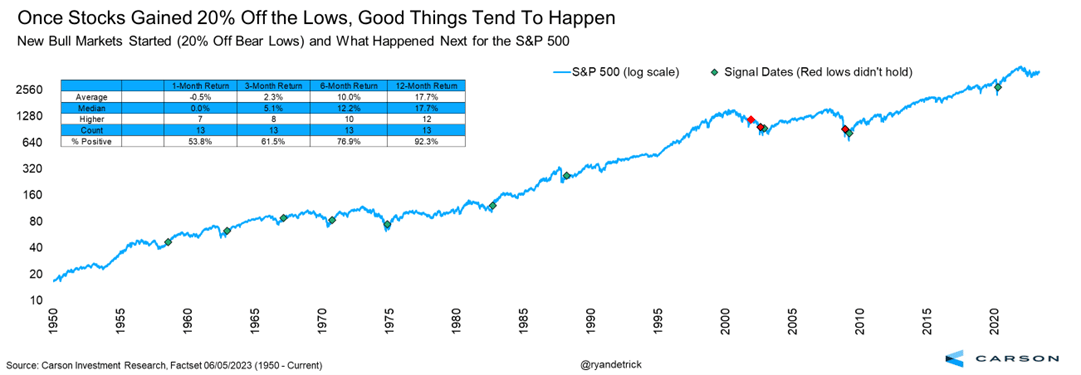

Chief Market Strategist Ryan Detrick of the Carson Group ran the numbers and found that since 1950, of the 13 times stocks jumped 20% off their 52-week low, the lows were indeed in the rearview mirror ten of those 13 times.

The only times stocks ignored the new bull market and moved lower occurred twice during the 2001 dot-com bubble and once during the 2008 Great Financial Crisis.

"In other words, some of the truly worst times to be invested in stocks," Detrick said.

After the 20% threshold was met, the S&P 500 saw an average gain of nearly 18% in the 12 months that followed.

There are a few reasons why further gains could be in store for stocks.

Inflation is starting to moderate, and that should give the Federal Reserve some breathing room in ending its interest rate hikes.

Recall that the Fed's aggressive interest rate hikes throughout 2022 helped worsen the bear market decline in stocks last year.

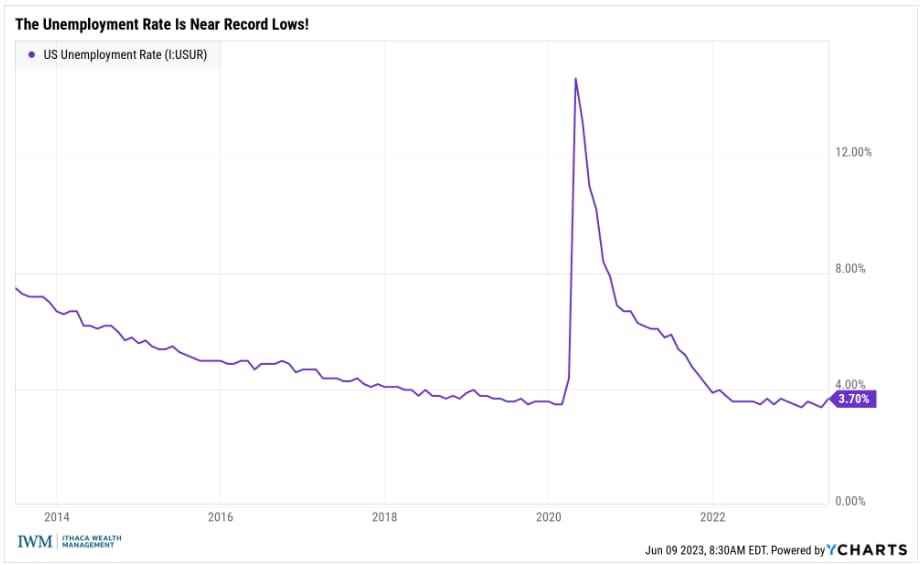

Additionally, corporate earnings continue to be much better than analysts expect and the job market and broader economy remains incredibly resilient thanks to solid consumer spending.

I think the CFO of MasterCard summarized this dynamic well on the company's most recent earnings call.

"Unemployment levels remain at record lows, so strong from an employment standpoint. When people are employed, they get paychecks, when they get paychecks, they tend to spend," MasterCard CFO Sachin Mehra said.

And that's really all that matters: consumers holding onto their jobs.

All of this is not to say that the coast is clear and stocks will only go higher from here.

There are still plenty of risks abound, and volatility could perk back up next week when the Fed makes another interest rate decision and we receive more inflation data.

Any hiccups there could reawaken the bearish spirits and lead to a sell-off. So while some cautious optimism is warranted, be prepared for anything.

Wall Street Etymology

By the way, ever wonder why they call it a bull or bear market on Wall Street?

The etymology of the terms are a bit fuzzy, as there are a few different explanations.

One idea goes that when bulls attack, they get their horns low and jump up to hit their opponent, while a bear often stands tall and swipes in a downward direction with its claws.

The other common explanation is that bulls charge, which is akin to a busy stock market, while bears hibernate, akin to a sleepy stock market.

🙏 Thank You For Reading!

As always, thank you for your continued trust in Ithaca Wealth Management. It’s a privilege for me to help you navigate today’s uncertainties. Please reach out with any thoughts or questions about any aspects of your financial life.

I am here to help. You can call me at (607) 882-1434, or e-mail [email protected].

Have a great weekend!