It takes a strong foundation to build a great structure.

The same goes for the economy and stock market.

What has become increasingly clear over the past month, quarter, and year, is that the underlying foundation of the US economy is strong.

Sure, there are pockets of weakness in commercial real estate and regional banks, and geopolitical tensions represent a constant risk that could upend the economy overnight.

But all things considered, it's looking pretty solid right now.

Consider the following:

The unemployment rate has been below 4% for two consecutive years, representing the longest streak since 1969.

The unemployment rate has been below 4% for two consecutive years, representing the longest streak since 1969.

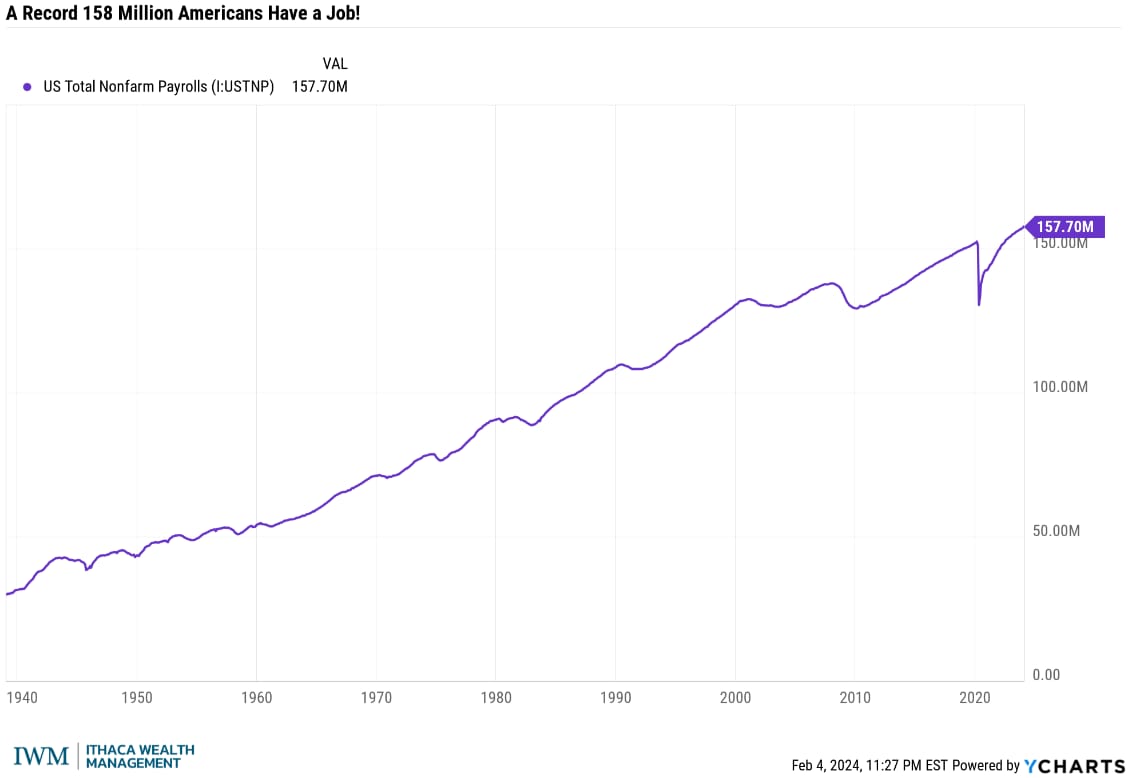

14.6 million jobs have been added to the US economy over the past three years — A record 158 million Americans are employed!

US GDP growth accelerated in 2023 to 2.5%, better than the 1.9% growth seen in 2022 and above pre-pandemic trends.

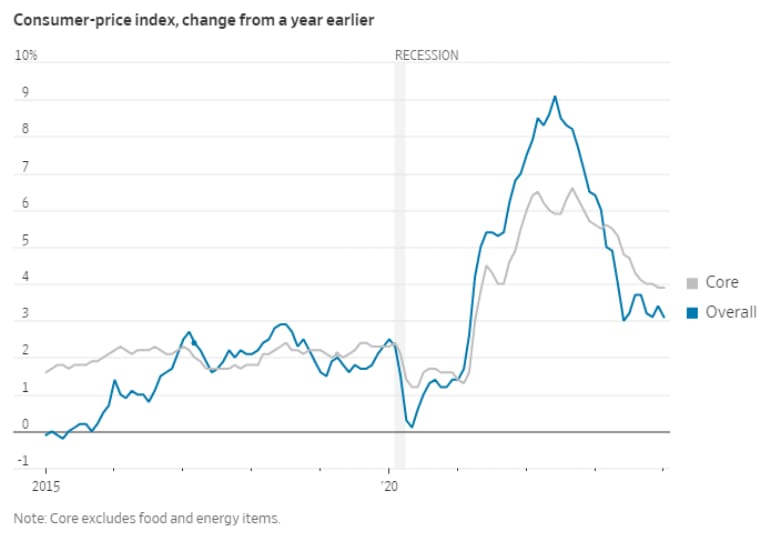

Inflation has fallen from the 9.1% peak in June of 2022 to 3.3%, approaching the Federal Reserve's long-term target of 2%.

Inflation has fallen from the 9.1% peak in June of 2022 to 3.3%, approaching the Federal Reserve's long-term target of 2%.

Lower interest rates help boost demand and serve as a tailwind for further profit growth, which drives stock prices in the long-term.

The stock market has responded to the strong data by hitting record highs. And record highs in the stock market could continue on for as long as the job market stays strong.

Because at the end of the day, it's consumers (us!) who are powering this economy higher, and consumers will keep spending their money for as long as they still have a job.

This, combined with a few other factors, can lead to a sort-of "Goldilocks" cycle for the economy.

For as long as the job market is solid, businesses will reinvest to become more efficient.

Those efficiencies should lead to productivity growth.

Productivity growth enables non-inflationary growth.

Non-inflationary growth gives the Federal Reserve the flexibility to enact easier monetary policy through lower interest rates.

Lower interest rates help drive a strong jobs market.

For as long as the job market is solid...

And then the cycle can turn virtuous, leading to an extended period of economic growth barring any exogenous shocks.

There are two structural forces that are driving this strong economy.

1. Favorable Demographics — Millennials are the largest generation in the US with a population of 72 million, and they're starting to enter their peak earning years (30 - 50 years old). This period of time typically includes getting married, buying homes, starting families, and getting work promotions.

All of these life events are stimulative to the economy.

And don't forget, Gen Z is right behind millennials, with a population size of 69 million.

2. Technological Innovation — Generative artificial intelligence (ex. ChatGPT) will likely go down as the biggest technological advancement since the internet.

While it's not perfect, it is groundbreaking, and it will only get better over time. And with those improvements should come new sources of growth and improved efficiencies.

Meanwhile, in health care, a new class of weight loss drugs has redefined the standard of care for patients with type 2 diabetes, and the second-level effects could be massive.

Aside from drastic weight loss (~20% body weight), patients taking GLP-1 drugs like Ozempic/Wegovy and Mounjaro/Zepbound have seen a sharp reduction in sleep apnea symptoms, a noticeable reduction in heart attacks, an improvement in osteoarthritis symptoms, a reduction in addictive behaviors, and in some cases diabetes went into remission.

These GLP-1 drugs could significantly increase life expectancies and reduce the burden that adverse health issues can have on the economy once supply chain and insurance coverage issues get sorted out.

Across all sectors, innovation is iterative and constant. It seems to be speeding up, not slowing down, and it compounds over time, just like the stock market.

Buying Stocks At Record Highs

The S&P 500 passed the 5,000 milestone earlier this month for the first time ever.

While they should be celebratory, these round-number milestones have a tendency to evoke fear in investors, as nobody wants to buy stocks at the peak right before a decline.

That's especially true considering that the 50% stock market sell-offs during the 2000 dot-com bubble and 2008 Great Financial Crisis are still top of mind for a large group of investors. Not to mention the 35% decline experienced in March 2020, and the 25% decline seen in 2022.

At record highs, I often hear from clients: Is now still a good time to invest? Should I wait for a correction before investing new money?

I think it's important for investors to consider the following:

History suggests that new highs in the stock market are bullish, not bearish.

From 1988 to 2020, buying stocks at all-time highs generated better performance on a 1-year, 3-year, and 5-year basis than buying stocks on any day.

This positive historical data, combined with a solid economy, cooling inflation, resilient consumer, strong jobs market, and the likelihood of lower interest rates, suggests that now is a great time to buy stocks for the long-term.

Fed Interest Rate Cuts

The prospect of interest rate cuts from the Federal Reserve in 2024 may seem perplexing when the economy continues to be resilient.

Typically, the Fed hikes interest rates during a strong economy to limit inflation by tempering demand, and it cuts interest rates during a weak economy in a bid to stimulate demand and drive a recovery.

But the Fed already hiked interest rate considerably in 2022 and 2023, and with inflation nearing the Fed's long-term target of 2%, they can afford to "adjust" the current level of interest rates lower.

This scenario is reminiscent of the Fed's interest rate cuts in 1995.

Here's what happened:

An economic recession in 1990 caused the Fed to lower interest rates from 8% to 3% by 1993. The economy quickly rebounded and inflation heated up, so the Fed "normalized" interest rates back to 6%.

By 1995, inflation had moderated back to around 2%, so the fed cut interest rates three times to about 5%.

Below is a chart of the Dow Jones Industrial Average in the early 1990s.

h/t: @FusionPtCapital

The Fed cut interest rates at a time when the stock market was at record highs.

Turns out, buying stocks in 1995 was a smart move, as the market never looked back.

The combination of tamed inflation, a solid economy, and interest rate cuts from the Fed has historically been a winning environment for the stock market, and it's the type of environment we could be living in for the next few years.

h/t: @FusionPtCapital

To be absolutely clear, the stock market can't go straight up. We will likely soon experience another sell-off that shakes the confidence of investors.

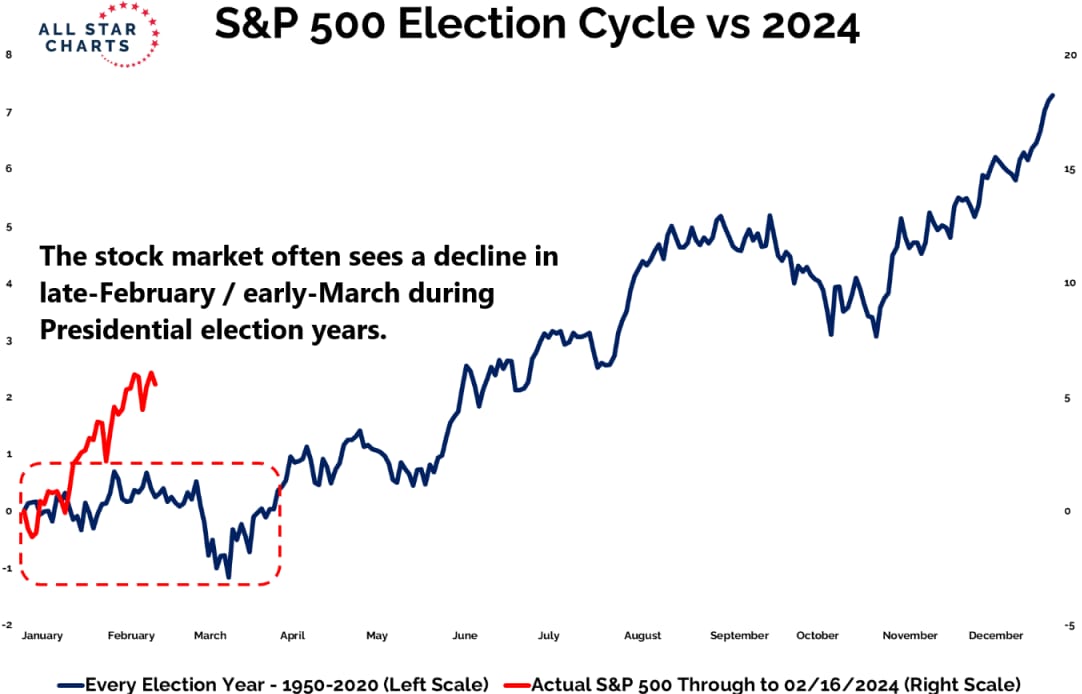

The stock market on average experiences three 5% sell-offs and one 14% decline every single year. And from a seasonal perspective, the end of February and first half of March tend to be a poor time for stocks.

So, temper your expectations, yes. But also, keep investing and stay invested with the view that the next inevitable decline should yet again be an opportunity for you to take advantage of.

There's a lot of favorable dynamics occurring right now in the economy, and you shouldn't let new highs in the stock market prevent your from benefitting.

I am reminded of famed-investor John Templeton's quote:

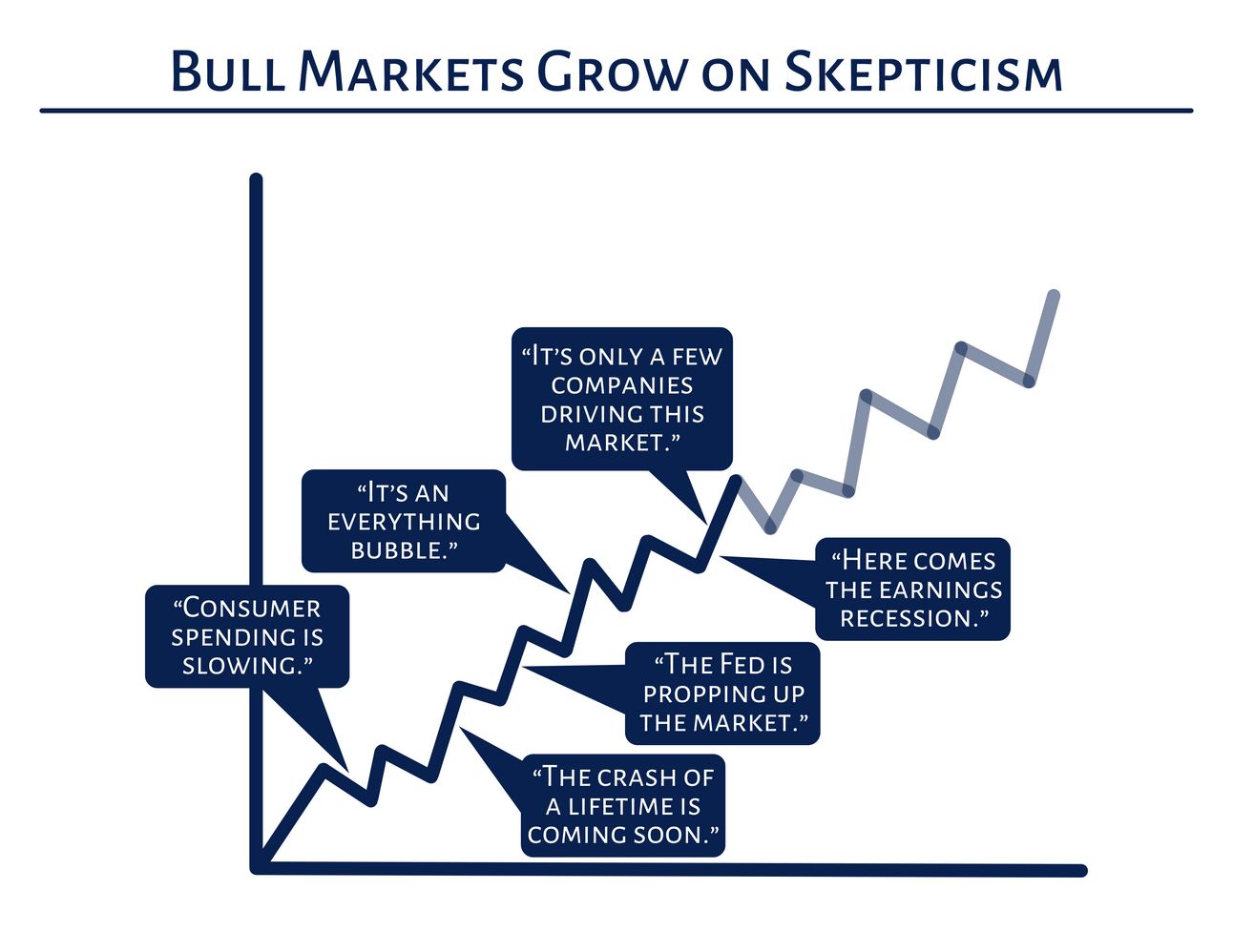

Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.

Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.

I'm still seeing a lot of skepticism in today's markets.

@MoneyVisuals