Last summer I stumbled upon a yard sale in my neighborhood, just a few blocks down the road from me.

I have learned over the years that I am a sucker for antiquing, evidenced by the fact that Antique Roadshows on PBS has turned into one of my favorite TV shows.

Some of my favorite buys over the years include an incredibly detailed map of New York State from the 1920s, a mint-condition wood encased Sony radio from 1970, and a perfect-fit forest green business jacket that's almost double my age.

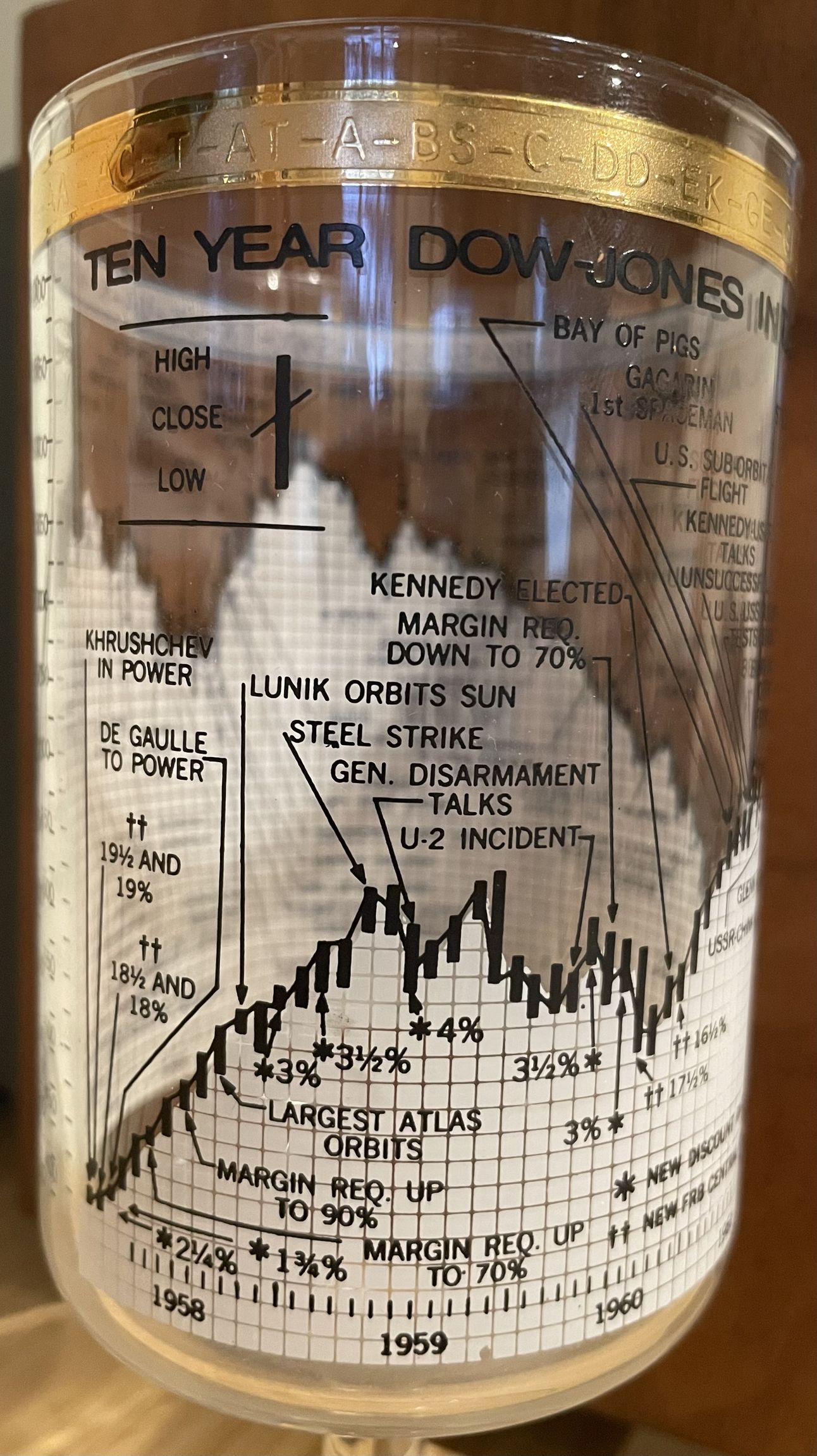

During last summer's yard sale hunt, I stumbled upon a box of kitchenware items and found a peculiar gold-rimmed drinking glass that I had to have.

The glass goblet has a wrap-around graphic titled "Ten-Year Dow Jones Industrial Average" with ten years of stock market history and market moving events printed on the glass.

How much? $5. Deal!

The glass goblet charts the stock market from 1958 to 1968, and during that time, there was plenty of turmoil.

Labor strikes in the steel, auto, and airline industries, US tensions with Russia and China, crisis in the Middle East, the Vietnam war, and the assassination of President John F. Kennedy were just a few of the negative headlines.

Yet despite all of that bad news, the Dow Jones doubled from 1958 to 1968.

2023 is very different than the 1960s. Yet some of those headlines sound eerily similar to today's headlines.

Investors have had to grapple with auto strikes at the big three Detroit automakers, the outbreak of the Israel/Hamas conflict in the Middle East, and increased tensions between the US and China/Russia.

Despite all of the bad news, the stock market has risen considerably in 2023, with the S&P 500 up about 20% and the Nasdaq 100 up more than 50%.

Like Clockwork - Seasonals

Stocks took a pretty big tumble in August, September, and October.

Concerns of a slowdown in the economy, high interest rates, and typical summer consolidation contributed to a 10% correction in the S&P 500.

But those losses have since been reversed as the seasonally bullish months of November and December get underway.

See the below chart from Fundstrat, which tracks the average path of the S&P 500 by month since 1950, with 2023's S&P 500 overlaid in black.

@Fundstrat

The stock market is closely following its bullish year-end seasonals, and that suggests record highs in the stock market could be reached in a matter of weeks.

Third Quarter Review -- What Recession?

For nearly two years, market pundits, macroeconomists, and Wall Street strategists have been forecasting an imminent recession.

But the data and consumers are dancing to a different tune.

Third-quarter corporate earnings were stronger than expected, third-quarter US GDP growth came in at a scorching hot 5.2%, inflation continued to show signs of easing, and retail sales continued to track higher.

This goldilocks scenario means that the Federal Reserve is most likely done hiking interest rates.

The Fed could even be on the verge of cutting interest rates, and not because the economy is slowing down, but because inflation has been contained.

If that's the case, then the stock market may have considerable upside potential heading into 2024.

The economy has been held up by a resilient consumer that is fully employed, and as long as those jobs are held onto, there's no reason to think that a recession is imminent.

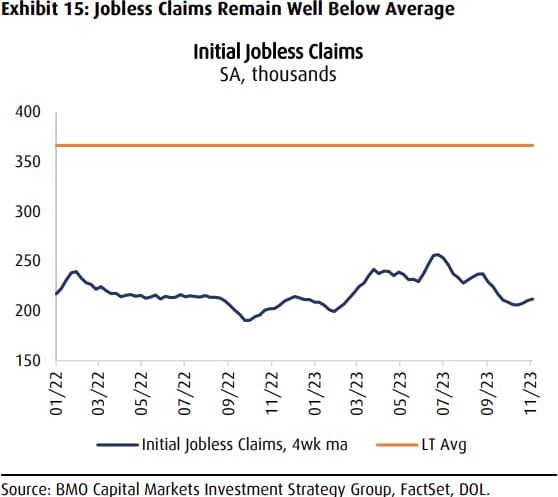

This chart shows just how strong the US jobs market is. Weekly jobless claim filings for unemployment insurance have hovered in the low 200,000 range for the past year, which is nearly half the long-term average of 360,000.

Recent Signs of Consumer Strength

Black Friday and Cyber Monday sales have shown encouraging signs that the consumer still feels confident spending their money.

Online shopping for Black Friday jumped 7.5% year-over-year to a record $9.8 billion, while Cyber Monday sales jumped about 8% year-over-year to $12.4 billion.

Altogether, consumers spent nearly $40 billion on beauty products, apparel, electronics, toys and more over the Thanksgiving holiday weekend.

Wow!

But the below graphic was the real eye opener for me. It shows a snapshot of the tens of thousands of planes that were in the air on Sunday, November 26. A record 2.9 million people were in the air on Sunday, according to TSA data.

Remember, Patience Pays!

@MoneyVisuals

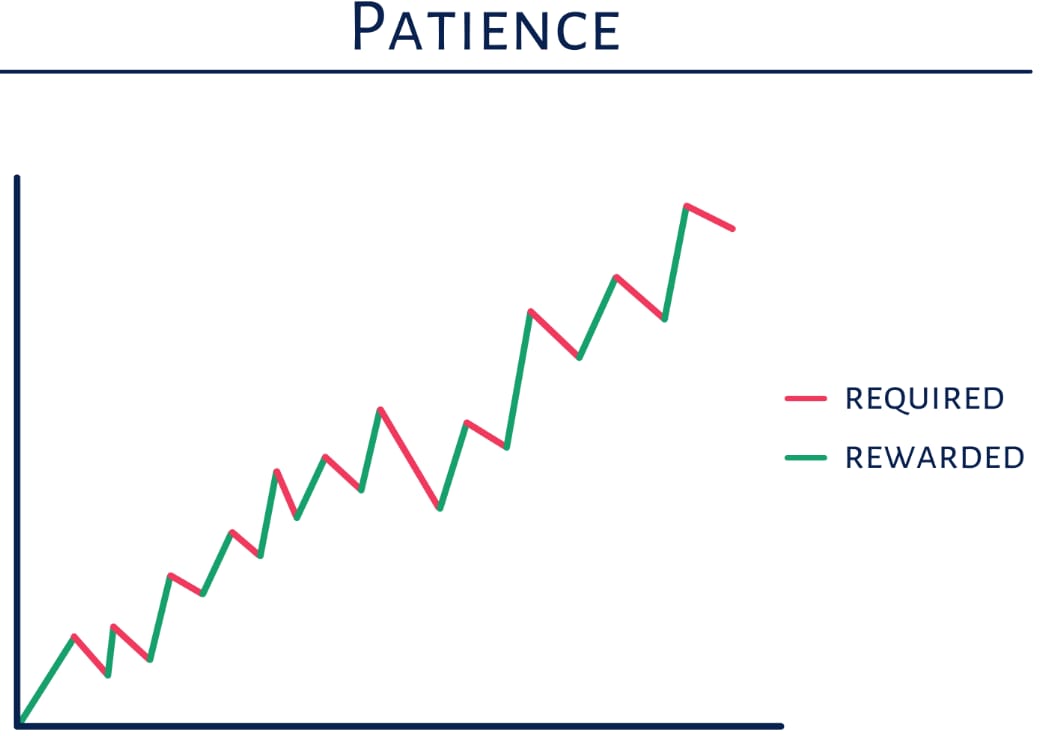

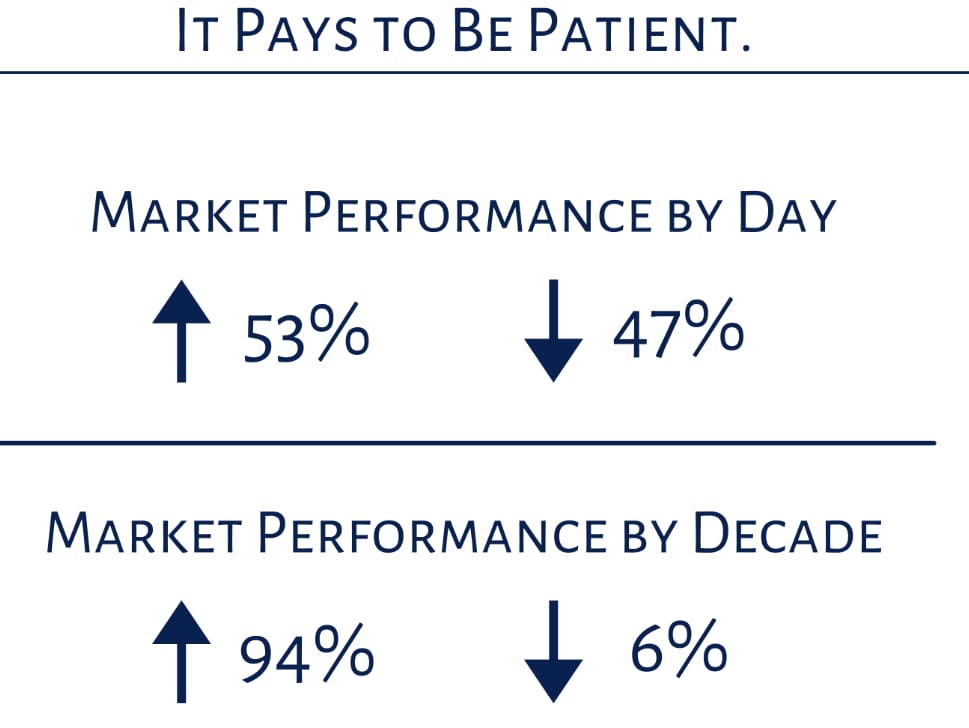

In the face of the everlasting risks that plague the stock market, and the economy, and the world, just remember that it pays to stay disciplined and invested based on your financial goals.

Because the requirement of being patient in the stock market is usually rewarded over the long-term.

@MoneyVisuals

Thank You For Reading! 🙏

Please reach out if you've experienced any major life changes recently of if you have questions about anything related to your portfolio or financial plan.

Ready to get started investing? Reach out!

I am here to help. You can call me at (607)-882-1434, or e-mail [email protected].