The stock market has officially entered bear market territory in 2022, with the S&P 500 down more than 20% from its peak in early January.

The closely-watched 20% threshold is nothing more than an arbitrary number, as famed-investor Howard Marks once said:

"Does it really matter whether the S&P 500 is down 19.9% or 20.1%? I prefer the old-school definition of a bear market: nerve-racking."

Today’s market qualifies under both definitions: down 20%, and absolutely nerve-racking.

Between the ongoing Russia-Ukraine conflict, 40-year highs in inflation, and aggressive Fed rate hikes to tame that inflation, there's plenty for investors to be worried about.

What makes the current situation even more difficult to stomach is the fact that while stocks declined considerably so far this year, so did bonds.

Bonds have historically provided valuable diversification benefits to investors during periods of stock market stress, but even they have not been immune to the Fed's swift 3.00% hike in interest rates so far this year.

But one reminder worth repeating is that these types of declines have happened before, and they're actually par for the course when it comes to investing (the price of admission is my preferred metaphor).

Below is a list of all bear markets since 1950.

Each one of these historic declines felt scary in their own way, based on the headlines at the time (global pandemic, US housing crash, 9/11 attacks, 1970's stagflation and so on).

And yet, looking back on them, it's not hard to conclude that all of those past concerns, while very serious (and scary), were ultimately surmountable.

Are today's challenges facing investors, the economy, and the world surmountable? Nobody knows for sure, but I'd wager to say that yes, this too shall pass, and no, the world is not about to end, and yes, the US population will continue to grow.

And sometimes, it's as simple as that.

To add even more perspective and really hammer in the idea that 2022's stock market decline is completely normal based on historical price action, consider that right now is seasonally the worst time for stock market performance, and on multiple magnitudes.

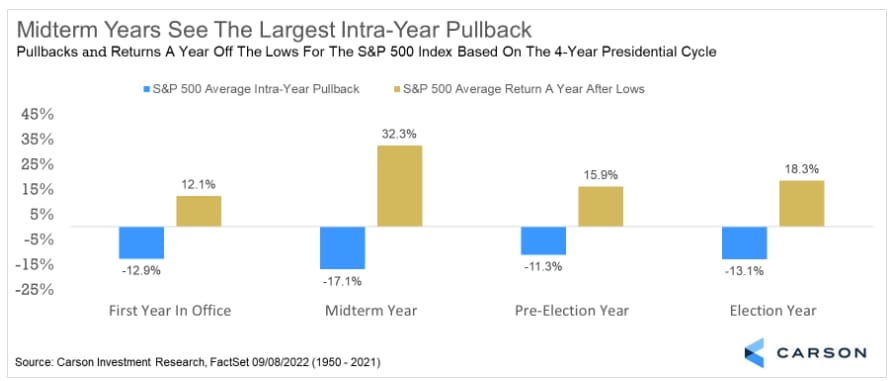

Not only is September historically the worst month of the year for stock returns, so is the mid-term election year of a presidential term. That's a double whammy.

As control of Congress is up for grabs, investors tend to get more skittish leading up to a mid-term election, with stocks falling 17% on average. That's not far off from 2022's YTD decline of 20%.

The good news is that, historically speaking, the big -17% average decline in stocks is often met with an even bigger 32% average advance in the year after the mid-term election lows.

And that makes sense when you consider that stocks usually bottom on really bad news. Remember, when the time comes to buy, you won't want to!

What's happened in the stock market's past doesn't mean it will automatically repeat in the future, but humans have a tendency to make the same emotional mistakes when it comes to managing their money, so don't be surprised if history rhymes and stocks mount some type of recovery into next year.

Confront The Bear

Over the summer I went backpacking in the Sierra Mountains, just outside of Yosemite National Park for a few days. The experience was somewhat foreign to me, but thankfully for my wife Mia, it was a stroll in the park. She grew up camping.

One shock to me was that we could very well encounter a bear during our trip.

Bear Rule No. 1: Always secure your food in a bear-proof cannister.

Bear Rule No. 2: Stand your ground during a chance encounter.

Bears can run up to 30 mph, so you can't outrun them, and they're excellent tree climbers, so no use in trying that.

But bears are often in bluff mode when they attack, betting that their target will cower in fear, freeze, and fail to put up a fight. That means, especially for black bears, it's imperative that you stand your ground, wave your arms, and make loud noises to scare them off.

I think those same rules apply to investors when it comes to bear markets.

Have a plan, confront the bear, and don't cower in fear (as scary as it might be).

If you're still in the wealth accumulation stage of your life and your budget allows, take advantage of the decline!

Now is not a bad time to increase your 401(k) contributions at work or setup/increase your recurring contributions to a taxable brokerage account.

As always, ensure that you have at least 3+ months of living expenses sitting in cash, and preferably 6+ months of living expenses in cash if you feel uneasy about your current job security.

If you're currently in capital preservation mode, now is a great time to review your current portfolio holdings to ensure that your risk profile matches the amount of risk you are actually taking on.

And finally, stick to the plan, because the view is usually a lot better on the other side.