With the days getting shorter and the leaves already falling, 2022 is somehow right around the corner, and there’s a lot to be excited about.

Daily cases of COVID-19 are again on the decline, the US consumer is in their best financial shape in decades, and the economy appears poised for more growth ahead.

On the flipside: rising inflation, ongoing supply chain bottlenecks, and a looming December 3rd debt ceiling deadline represent just a few risks that could hurt the economy and derail the stock market’s seasonal rally that often materializes into year-end.

Even with stocks near all-time highs, there’s a lot of uneasiness and fear among investors. But even though the short-term risks represent a clear and present danger, their associated downside potential is significantly outweighed by the long-term upside potential of high-quality businesses that not only adapted to a global pandemic, but thrived. Read on in IWM’s Q3 review.

The Stock Market Has a Selective Memory

How else could the stock market be up more than 20% year-to-date despite all the risks facing the economy? It comes down to the stock market having a selective memory, just like investors.

The only difference is that while the stock market tends to remember the positives, investors like to remember the negatives. That’s especially true for investors that experienced the market volatility of the 2000 dot-com bubble, the 2008 housing crisis, and/or the 2020 pandemic.

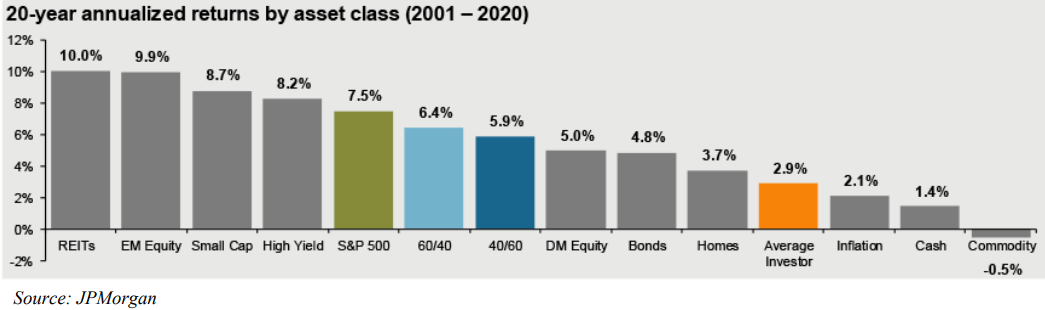

Losing money is psychologically taxing, which is why downside protection tends to be of more concern to investors than participating in upside gains. This helps explain why the average investor has seen annualized returns of only 2.9% since 2001, while the S&P 500 returned 7.5%.

While the stock market exclusively looks to the future, investors too often remain anchored to the past, examining outdated data to frame whatever beliefs they may hold at the time.

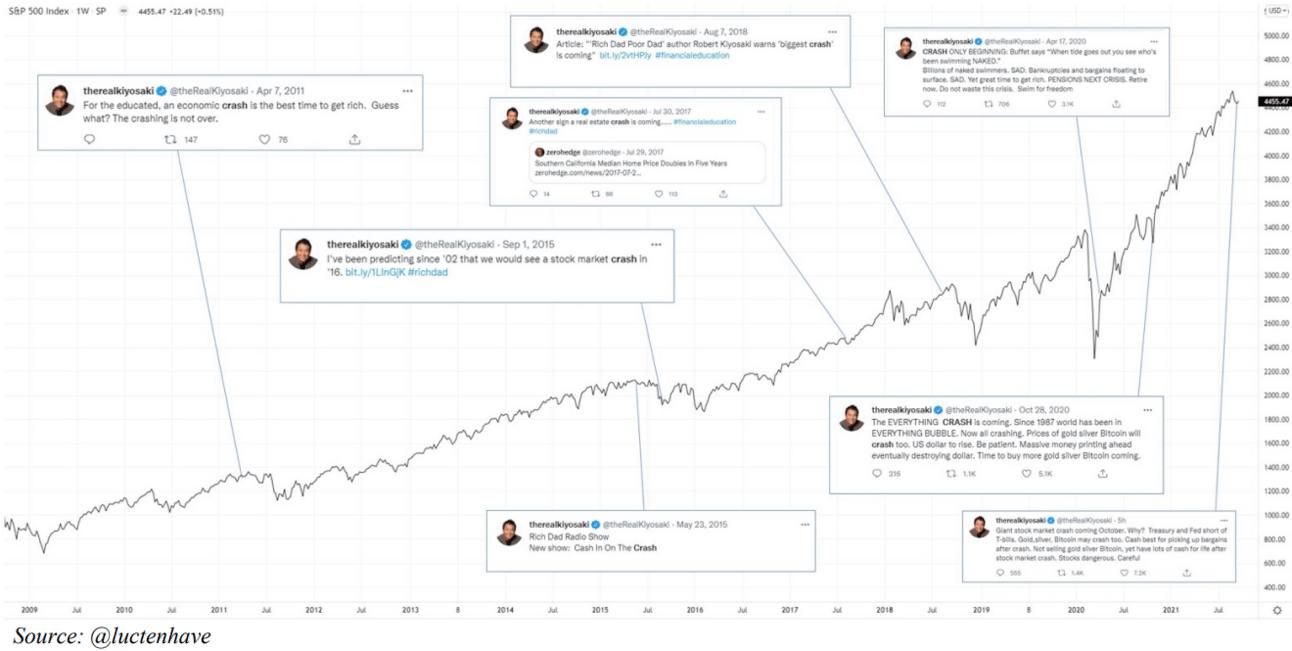

It’s why well-known investors have been consistently calling for an epic stock market crash ever since the 2009 bull market began. And even after last year’s 35% stock market sell-off amid the pandemic, they’re still predicting another imminent crash.

So, what could cause such a dramatic decline in stock prices even as the economy continues to recover from the pandemic?

Recently, it was the potential default of a Chinese property developer named Evergrande. Then, it was the potential US default on its own debt amid political gridlock. Today, the flavor of the bear is prolonged inflation that leads to hyperinflation which ultimately leads to the end of the US dollar as we know it.

But the stock market’s selective memory is ignoring all of that, and instead focusing on what really matters:

Corporate earnings growth, which is on pace to hit new records in 2022 after an exceptionally strong 2021.

Corporate stock buybacks, which are expected to hit a record $1 trillion next year.

An ongoing $70 trillion wealth transfer from older generations to younger generations, which flows out of safer fixed income investments and into riskier assets like stocks.

A demographic tailwind for the economy, driven by Millennials and Gen Z reaching their peak career earnings, buying homes, and forming families over the next 3+ decades.

Ongoing technological advancements in renewable energy, artificial intelligence, and even autonomous driving, all of which help boost productivity and lower prices.

And most importantly, representing 70% of US economic growth: a strong consumer.

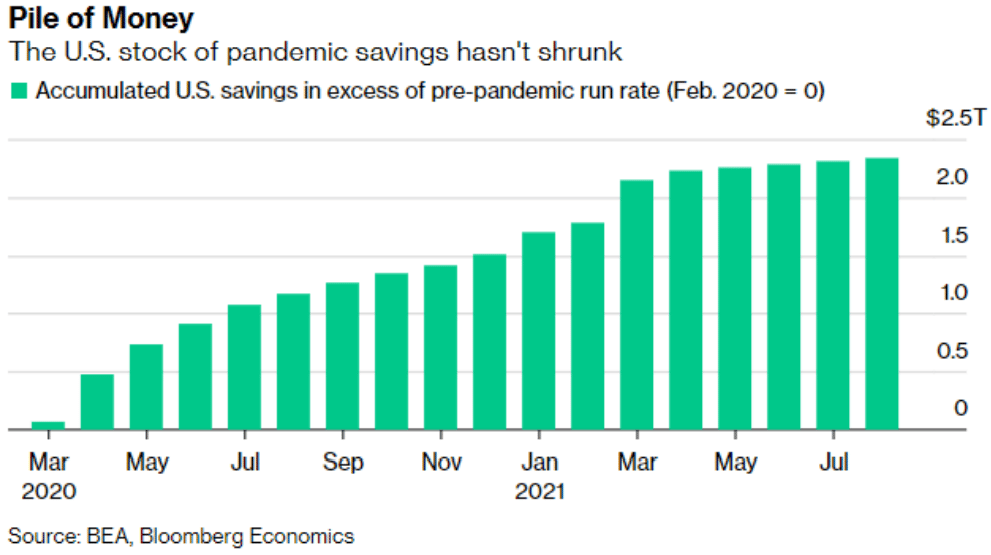

Just how strong is the US consumer? Since the pandemic, they’ve added trillions of dollars to their balance sheet, paid down debts, and are now sitting on a record household net worth of $144.5 trillion.

Their monthly debt payments as a percentage of disposable income plummeted to a more than 40-year low of 8.5% in the third quarter. And the job recovery from the COVID-19 pandemic is much faster than prior recessions, signaling that the strength of the consumer could be long lasting since labor remains in high demand.

Altogether, this means investors should shift more of their focus away from the constant barrage of short-term risks that always keep them with one foot out the door ready for the exits, and instead towards the long-term upside potential, as this will help you stay invested in the best companies and build wealth despite the inevitable volatility.

Investor Bill Miller summed it up perfectly in his most recent letter:

“When I am asked what I worry about in the market, the answer usually is “nothing”, because everyone else in the market seems to spend an inordinate amount of time worrying, and so all of the relevant worries seem to be covered. My worries won’t have any impact except to detract from something much more useful, which is trying to make good long-term investment decisions.”

Third Quarter Review

The S&P 500 was on pace for a 6% gain in the third quarter, until September rolled around. The index suffered its first 5% sell-off in nearly 12 months as fears of the US defaulting on its debt converged with China real estate developer Evergrande’s near default on its $300 billion pile of debt.

On top of that, the Federal Reserve signaled that it would begin to taper its $120 billion monthly bond purchasing program that was put in place at the start of the pandemic to help calm credit markets and provide liquidity to businesses.

And yet again, despite the headline risks and 5% sell-off, the stock market did the exact opposite of what most people thought it would do and recovered, climbing the never-ending wall of worry to hit record highs by late October.

Democrats reached a deal with Republicans to raise the US debt ceiling until early December, Evergrande made its debt payments in time to avoid default, and investors mostly shrugged at the Fed’s decision to end its bond buying program, instead focusing on when they will begin to raise interest rates (consensus is split between late 2022 and early 2023).

Ultimately, the S&P 500 eked out a half-percent gain in the third quarter. While disappointing to some, it’s a perfectly fine return given that the S&P 500 has doubled from its March 2020 low in just 17 months. Sideways consolidation is a necessary characteristic of healthy bull markets. Stocks can’t go up in a straight line. There needs to be an ongoing give and take between buyers and sellers as an equilibrium is found in the marketplace.