If you were like me on Wednesday night, your eyes were glued to Twitter, scrolling with horror as a cascade of videos showed on the ground footage of Russia launching an offensive attack against its neighbor, Ukraine.

Panic around the globe quickly set in, and for good reason. Russia launched the most devastating conflict on the European continent since World War II, and all of a sudden the risk of a tit-for-tat escalation between Russia and NATO members became all too real.

It goes without saying that the attack by Russia is a tragedy, and the loss of life will likely be staggering by the time this conflict comes to an end.

And while it may feel inappropriate to talk about the implications a tragedy half way around the world may have on your money, I know nerves are high right now and that perspective can help alleviate at least some concerns and keep you committed to your long-term plan of building wealth.

Now, If you hopped into a time machine and traveled back to Friday, February 18 to give me a heads up about the imminent Russia invasion, I think it's safe to say that I and most other investors would have lost money.

That's because the forward-looking stock market once again pulled off its incredible ability of doing the exact opposite of what the majority of people think it will do.

When stocks opened for trades Thursday morning after it became clear that Russia was invading Ukraine, the Nasdaq 100 immediately plunged 3%, briefly entering bear market territory (down 20% from its record high).

The panic selling was palpable, as widely held stocks across the board were indiscriminately sold by investors.

But throughout the rest of the day, stocks slowly inched higher before the Nasdaq 100 ultimately finished the day up more than 3%. Another 2% gain was added on Friday as stocks staged an impressive follow through.

All-in, despite a full-scale invasion of Ukraine by Russia, representing the most volatile geopolitical tensions since the Cold War, US stocks finished the week higher and the Nasdaq jumped 9% from its Thursday low.

That's not unusual, based on historical market performance around wartime events.

Source: DFA

This helps sums up the title of this note, that it's near impossible to consistently time the stock market, even if you heard the bad news before everyone else.

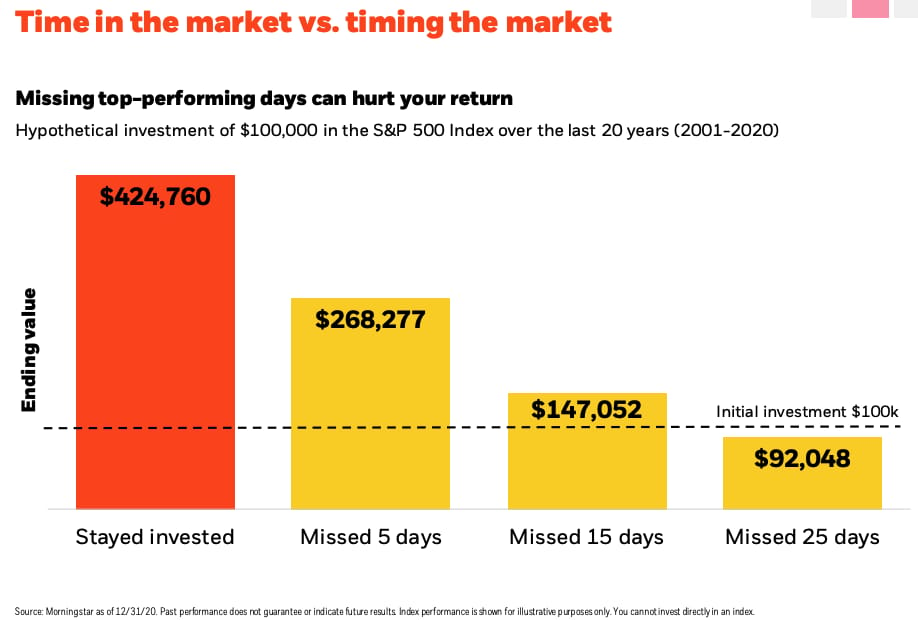

And what adds even more significance towards this cautionary message about trying to move in and out of the stock market with your money, is the devastation it can have on your long-term portfolio returns and financial goals.

That's because while missing the worst days in the stock market will surely save you money and boost your portfolio performance over the long-term, missing the best days in the stock market will do the exact opposite.

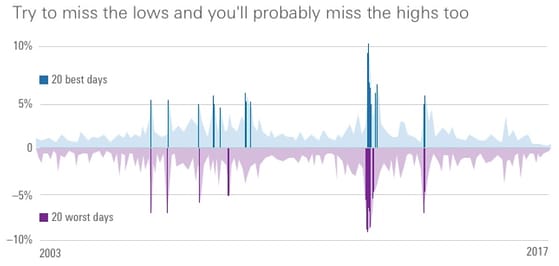

And historically, both the best days and the worst days in the stock market happen in clusters right next to each other when volatility is high.

Consistently having the mental fortitude to sell out of stocks right before a bad day in the stock market and buy back right before a strong rebound in the stock market is not realistic and would be psychologically taxing.

Source: Vanguard

"When the time comes to buy, you won't want to," says market veteran Walter Deemer. That's because the news of the day will be so overwhelmingly negative when stocks are on sale, it will feel crazy to buy.

All of the above does not mean you (we) are powerless to the erratic swings in the market. For one, if the recent market volatility has you losing sleep, that's a good indication that your risk profile may not be aligned with your portfolio allocation. Let's have a conversation to get you on the right path.

If you have a long enough time horizon and are comfortable with the volatility, this is your opportunity to put some cash to work and buy high quality businesses that will see little impact from the crisis overseas. Let's have a conversation.

Fundamentally, it's worth pointing out that Russia and America don't do much business together. Of all the S&P 500-member stocks in the IWM portfolio, only PepsiCo and McDonald's have significant exposure to the Russian economy. For both names, revenue exposure to Russia stands at less than 5%.

This is not to say that stocks can't continue to trend lower, especially if Russia escalates its aggression against Ukraine and/or NATO members. The country controls a large swath of natural resources that if cut off from the global economy, could lead to rising commodity prices, which would trickle down to everything from the price of gas to certain foods.

And if those price increases are sustained for a long enough period of time without a diplomatic resolution, it could hurt consumer sentiment and spending, which in turn would be a negative for corporate earnings and drag down stock prices even further. Not to mention, the Fed is still expected to raise interest rates, which represents another headwind investors have to deal with.

But anything can happen, and the future is uncertain. Rather than placing a bet on one scenario playing out over the other, have a plan, stay diversified, and please reach out with any questions or concerns.