Record employment. Record corporate profits. Record stock prices.

This is what a bull market looks like.

Sprinkle in a demographic powered boom in the housing market, the growing promise of artificial intelligence and its potentially massive impact on productivity, and healthcare breakthroughs targeting everything from obesity to cancer, and it's not difficult to imagine the good times rolling on for a while longer.

And yet, sentiment outside of Wall Street isn't great.

Consumer sentiment is still in "meh" territory with Americans' view on the overall economy pretty dour. A lot of people are still waiting for the recession they thought would arrive in 2023.

It's a weird juxtaposition given the overall strength in the economy, and it's likely driven by a hangover effect from the high inflation over the past few years and an increasingly polarizing political environment.

And investors aren't fully bought into the stock market rally, evidenced by a record $6+ trillion sitting in money market funds.

Torsten Sløk at Apollo

A rather large cohort of investors would rather collect a risk-free 5% return on their cash than invest in the continuous advancement of the human race.

To be clear, parking up to a year's worth of living expenses and money for short-term goals in a money market fund is a sound financial decision and one I wholly recommend, but something tells me a big chunk of this $6 trillion sitting in cash isn't for short-term goals but is rather long-term money waiting to be invested.

While a 5% risk-free return is no doubt an appealing proposition, it comes with a massive opportunity cost.

The S&P 500 is up 11% so far this year, or more than double the annual cash return of 5%, and it's up nearly 40% since the start of 2023, when 5% interest rates first became available.

The message I am trying to convey is that, despite record highs in the stock market, it doesn't feel like investors have the same level of euphoria that has so often coincided with market peaks like in 2021, 2007, and 2000.

And that means, in all likelihood, that this 19-month old bull market is just getting started. The average bull market lasts about 5 years.

By no means is this a call to "bet the farm" on stocks.

Rather, it's a call to stay the course. Remain vigilant, remain level headed, and remain invested according to your long-term plan.

Remember: Stocks do go down

@MattCerminaro

In the investment industry, the common phrase is "No risk, no reward."

In the fitness world, the phrase is "No pain, no gain."

And according to my Australian friend George, the saying is "you have to risk it for the biscuit."

It all means the same thing.

We couldn't have the current bull market in stocks if we didn't have the painful bear market in 2022 that led to a sharp 20% decline.

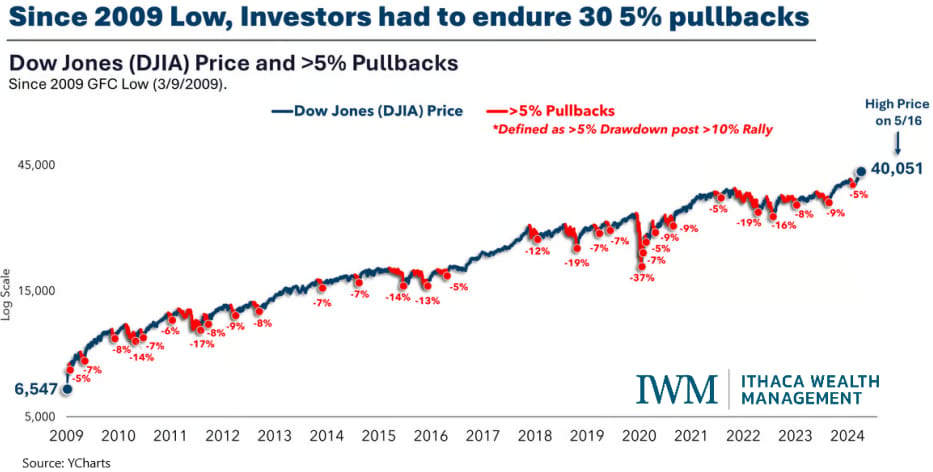

The chart above helps illustrate all the pain that investors have had to endure to benefit from today's record high stock prices: 30 sell-offs since 2009 that ranged from as small as 5% to as big as 37%.

This is a friendly reminder that as great as the current bull market might feel, be ready for the next inevitable stock market sell-off, because it's simply a matter of when, not if.

And knowing it's going to happen will increase the chances that you will take advantage of it by buying stocks at attractive prices, rather than it taking advantage of you by panic selling stocks at low prices.

Don't Be Afraid To Buy Stocks At Record Highs

@MattCerminaro

I mentioned this in my last communication in March but I think it bears repeating.

There's a tendency for some investors to delay their purchase of stocks at record highs, with the idea that they'll wait for a sell-off before putting new money to work.

But historical data shows that it's actually a good deal to buy stocks at record highs. See the above chart.

Since 1970, the stock market has delivered stronger one-year, three-year, and five-year average returns if you bought stocks at a record high vs. buying stocks any other day.

The reason? Physics. Or more specifically, momentum.

Things in motion tend to stay in motion.

The S&P 500 has made 23 new highs so far this year. That may sound like a lot, and it is! But historically, there have been years with as many as 77 new record highs established by the index.

@MattCerminaro

So, what could drive continued gains in the stock market this year?

Interest rate cuts from the Federal Reserve wouldn't hurt. If the Fed cuts interest rates because they believe inflation is largely contained, it would relieve some pressure on the housing market via lower mortgage rates.

It would also help companies refinance their debt or raise new debt at lower costs, which could lead to more capital expenditures. That's good for the economy.

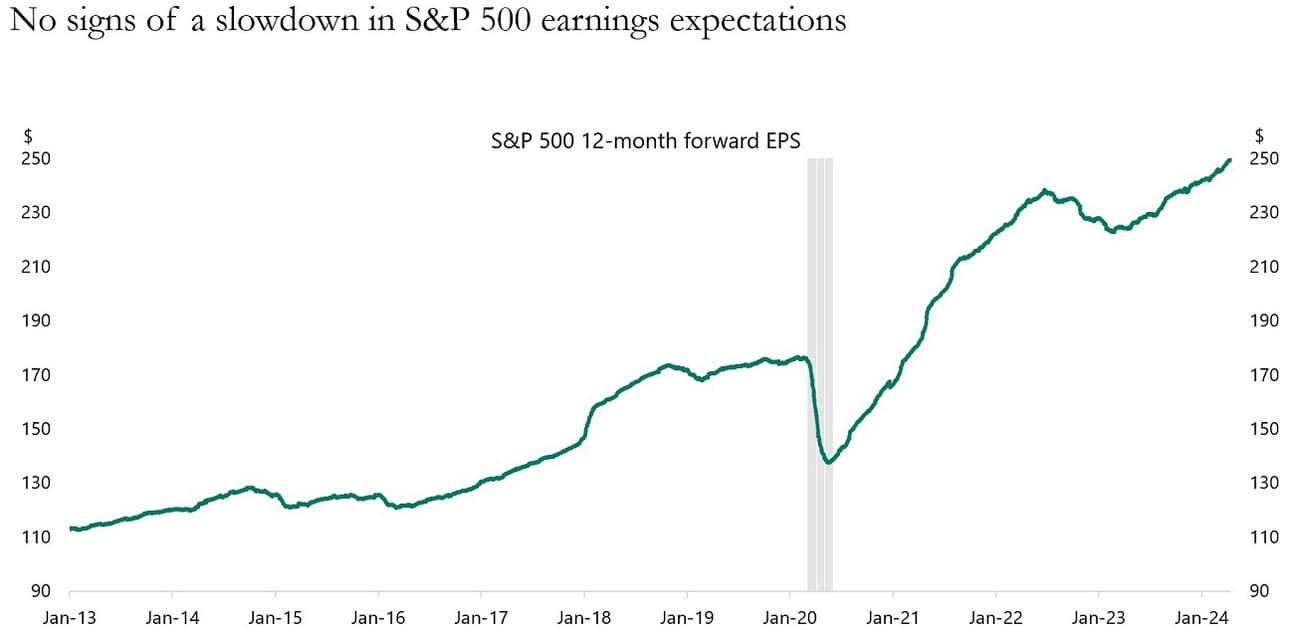

Ultimately what needs to happen for this bull market to continue isn't interest rate cuts from the Fed, though that would be welcomed, but rather a continued rise in corporate profits, because earnings drive stock prices.

And so far, so good.

Torsten Sløk at Apollo

And what potential risks could derail this stock market rally?

Rising geopolitical tensions are always a risk that could send oil prices soaring and stock prices lower. But that's a constant risk.

Perhaps the biggest risk the stock market faces is a potential deterioration in consumers' financial health. They have remained surprisingly reislient since the pandemic, buoyed by stimulus programs and record employment.

But recent commentary from some companies including Starbucks, McDonald's, and even Walmart suggests that consumers are starting to feel the pinch of inflation and are changing their spending habits. Walmart said it attracted a lot of high-income earners in the past few months, suggesting that some are trading down and looking to save a few bucks.

If other companies start to report similar changes in consumers' spending habits, then an economic slowdown could be imminent. But for now, as long as people hold onto their jobs, they're going to keep spending money.